Foresights and ideas that expand minds and inspire a change of heart.

Wall St is under occupation, banks like Dexia are once again asking for bail-outs, and the global financial system is weary of another Lehman Bros banking collapse. While it is easy to focus on liquidity, exposure, debt write-offs, and subprime mortgages, a more sobering conversation about the future of banking would look more strategically at the top 3 disruptive trends that are affecting banking now and in the foreseeable future.

There is something in the air when it comes to banking, and much like the global financial crisis may have spelt the beginning of the tipping point for a redistribution of economic power away from the United States and towards the BRICS, the current state of affairs in banking may indicate waves of change that are crushing an old business model that hasn't kept up with the times.

I was recently invited by a client bank to give them a futurist perspective (futuroloog in Dutch) on banking in Amsterdam, The Netherlands - home to some of the oldest and most sophisticated banks in the world - and to help them navigate a constantly shifting business landscape. Everywhere you look today, it's becoming evident that consumers and corporates are looking to alternative forms of banking, or rather the utility of financial transfer as my banking guru colleague, Brett King, would call it. Today's future focus is on the disruptions that are changing the banking environment at its core, and providing new opportunities for consumers, banks and non-traditional players alike.

Everything that can be digitised will be digitised. How are you now accessing movies, reading books, or listening to music tunes? Everything that can reduced to 1s and 0s will be reduced to 1s and 0s - including money. The idea that money in their analogue form will continue existing into eternity is ludicrous. The physical interaction with a bank, or even its branch extensions - the ATM - will seize to exist. 15% of Japanese mobile users already regularly use their mobile phones as payment devices, in Kenya the mobile phone is the most common form of everyday banking, and in Hong Kong, Octopus has become a deposit-taker. Mobile payments is one of Google's 3 main strategic goals, and Google already has a digital banking license in Holland. But how we banks avoid trading analogue dollars for digital pennies?

Two disruptive trends emerge from the digitisation of everything - two trends that should keep your organisation's leaders awake at night.

a. The first interesting thing about the digitisation of everything is that it enables non-traditional players to disrupt your industry. Think about these examples:

b. The second thing about the digitisation of everything is that it speeds up the race to zero pricing, or as the author of "Free" Chris Anderson calls it - "free". Free is upsetting business models around the world, and is forcing every business to become more creative and innovative in the way they generate dollars. Think about the following examples:

This raises the following questions:

Because of social media, we are all in media today. Organisations like banks need to look beyond their traditional industry and realise that their entire relationship with retail and corporate clients is shifting. Now, we all have media and entertainment devices that can act as deposit takers, wallets, and payment platforms in our back-pockets. Only banks that start to think like media companies will stand a chance in this race to be constantly connected to an increasingly mobile generation of consumers and corporate clients. If you can start to educate your clients, offer sophisticated yet simple advice, if you can design a process that gives your customers direct access to their net worth in graphic format via mobile media, provide tailored recommendations for investments based on your unique clients' risk-profile and particular market movements, you may still be able to 'own' the client relationship.

If you don't, non-traditional players like PayPal, Apple, Google, Amazon, and Facebook are likely to step into this space and remove the bank's brand to a back-end utility company of sorts that facilitates the infrastructure ncessary to move the energy of money from point A to point B.

These companies understand that they need to constantly engage with consumers. These consumers tend to have jobs that pay wages, and with those wages they tend to pay you for services. However, their retail behaviours are also translating into corporate behaviours. Blackberry's recent global coverage debacles have only increased calls for corporate staff for corporate Android and iPhone accounts. Whether it is Google or Apple that gain access to the pockets of customers, that mobile phone is the new branch, and if you don't own that brand touch point, your bank is likely to become totally commoditised.

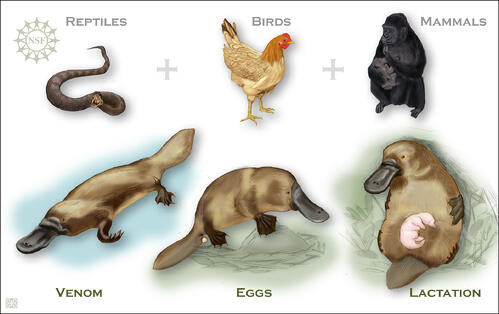

This is why media - both social and mobile - is so important. According to SAS business intelligence, 75% of companies don't know where their most important customers are currently talking about them, and a mere 7% are incorporating social media into their marketing and communications activities. 35% of smart phone users currently use banking and financial services applications on their phones, and 85% of all phones shipped in 2011 have a mobile browser. This enables non-traditional media companies to become media companies. Banks thus have an opportunity to morph into new industries and become a bit platypus-like as it were. This animal doesn't neatly fit into any one evolutionary category, and I believe it's the same with tomorrow's dominant companies.

These companies, by and large, are media companies, because it is through earned and owned media that we can constantly be in contact with our customers.

The third disruptive trend that is shaking up the banking industry, but which may also become its saviour is big data. We are living in an age of data deluge, with online players like Zynga generating 5 terabytes of data about its customers' behaviours and habits every day. Instead of demographics, big data enables smart companies to future focus on psychographics - the values, beliefs and attitudes of its customers. For examples, MasterCard has formed a business intelligence unit that uses MasterCard's exhaust-data - its customer purchasing data - for research and business advice. Southwest Airlines uses real-time data and social analytics to boost customer service and give their customers tailored offers, and Williams-Sonoma uses psychometric segmentation based on big data to market in a tailored fashion to its database, boosting response rates by 10-18 times. Insurance companies are now using RFID devices fitted to cars, to provide real-time data feedback on driver behaviours and changing premiums as a result. London buses come fitted with smart LCD screens that change advertisements based on which psychographic neighbourhood they drive through.

Banks are banks of data. Aside from privacy concerns, there is no reason why banks couldn't use its customer data to better tailor their investment products based on the very unique characteristics, risk profile and net worth of its customers (something that could have also helped avoid the sub-prime mortgage debacle). There is no reason why banks couldn't provide services like Mint.com which map your spending habits, and give your graphic insights into your finances beyond clunky excel spreadsheets, and that make personalised recommendations for your corporate or personal cash-flow. There is no reason why the exhaust data that banks generate couldn't be valuable to third party players who might be interested in targeting the High Net Worth Individuals the bank has as clients.

Data today is less about 1s and 0s and more about story, and like any media company that uses data cleverly (think Google), banks need to learn how to tell contextual and relevant stories, whether they use that customer data internally, or choose to on-sell it externally (staying privacy compliant of course).

These three disruptive trends will continue to shape the banking and financial environment for the years ahead, and they are perhaps as big, if not a bigger force for change than Wall Street protesters, and debt debacles in the long term.

Thanks for Brett King and McKinsey for the research quoted in this blog.

If you're interested in having me provide your organisation with a futurist perspective at your next conference, you can book Anders here.

Header Text

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat nulla pariatur.

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat nulla pariatur.

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat nulla pariatur.

Header Text

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat nulla pariatur.

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat nulla pariatur.

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat nulla pariatur.

Header Text

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat nulla pariatur.

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat nulla pariatur.

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat nulla pariatur.

& STAY UP TO DATE WITH FORESIGHTS AND TREND REPORTS!

WE WILL EQUIP YOU WITH THE VIDEOS AND MATERIALS YOU NEED TO SUCCESSFULLY PITCH ASN.

0 Comment